Buying health insurance is an essential in today’s day and age. The times are uncertain and the prices of healthcare are always rising. Medical inflation is an all-time high, this is one of the many reasons why buying a comprehensive health insurance plan is an absolute necessity today.

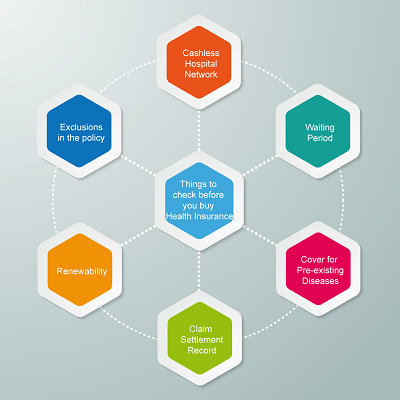

You will need to consider a few very important points before you zero-in to the best health insurance policy. Let us understand the top 7 most important points to consider before buying your first health insurance policy.

Top 7 points to consider before buying your first health insurance plan

Claim settlement ratio: A claim settlement ratio of an insurance company states that percentage of claims settled by that company. This is one of the most important insurance metrics that you should look for before buying a health insurance policy.

A high claim settlement ratio signifies that the insurance company settles most of the claims made by their policyholders.

Cashless facility: A cashless facility is where the insurance company will directly settle the respected medical bill with the network hospital. The policy buyer will not need to shelf anything out of his pocket. Be sure to check about your nearest network hospital as only networked hospitals offer this benefit.

Accidental coverage: Most comprehensive health insurance policies offer accidental coverage. That being said it is better to ensure that you confirm this fact by verifying your policy copy or asking your insurance agent about the same. Opt for a policy that provides accidental insurance coverage.

Pre-existing diseases: Another very important point to keep note of is whether your insurance policy provides coverage against pre-existing disease. If you have a pre-existing condition, your policy should cover this.

Waiting period: A waiting periodis a buffer period where the insurance company will not pass any claims made by you. You should ensure that your policy has the least waiting period possible.

Domiciliary hospitalization: There are times where domiciliary/home hospitalization is necessary. You should ensure that your policy covers home hospitalization if that is a priority for you. Most policies offer home hospitalization coverage but it is better to check your policy copy and verify the same.

Insurance riders: Ensure that your health insurance policy offers you the facility of insurance riders. Insurance riders are addons that a policy buyer can opt for. These addons offer the policy buyer the ability to customize his insurance policy. There are a multitude of different types of addons available in the insurance marketplace, choose the ones that work the best for you.

Magazine Today

Magazine Today